6 AI Tools for Invoice Processing - Save Time and Cut Costs

Businesses are turning to AI-driven invoice processing to handle time-consuming tasks. These smart systems take over data extraction and checking, cutting down on mistakes while freeing up your time for more important work.

Think about processing invoices in minutes instead of hours. Using tech like machine learning and optical character recognition (OCR), finance focused AI handles different invoice formats and gets smarter with each transaction. This doesn't just make your accounts payable run smoother - it gives you real-time insights into your money situation. Bringing AI into your invoice processing isn't just following a trend; it's a smart business move that keeps you ahead of the competition.

How Does AI for Invoice Processing Work?

AI transforms invoicing by automating the tasks that slow down your billing cycle. This technology makes your accounts payable more accurate and efficient.

Invoice Data Capture using AI

AI invoice tools use optical character recognition (OCR) and machine learning to pull information from invoices automatically. They grab invoice numbers, dates, vendor details, and amounts from any invoice format. This cuts down on mistakes that happen with manual data entry. Plus, these systems learn from past invoices, so they get better at extracting data over time.

AI Invoice Processing Workflows for Accounts Payable

AI changes how your accounts payable team works by automating verification through 2-way or 3-way matching, routing invoices for approval, and syncing with your accounting system in real-time. This helps you stay compliant with company policies and regulations. Your team can focus on tasks that need human judgment while the software handles the routine work. This saves money and makes your invoice processing more scalable without needing to hire more people.

Applications of AI for Invoice Processing

- Automated Billing Systems

These systems use AI to handle repetitive tasks like entering data. They speed up invoice creation while keeping accuracy high. This leads to smoother billing cycles and better cash flow.

- AI Invoicing Solutions

These tools streamline your entire invoicing process. They automatically extract invoice data, verify it, and route it for approval. This makes your whole system more efficient and helps you stay compliant.

- AI Billing Automation

AI transforms how you handle invoices by automating invoice matching and approvals. This speeds up payment cycles and lets your team focus on more strategic work.

- Reducing Errors with AI

AI validates extracted data against set rules and flags any problems for human review. This extra check helps prevent fraud and makes sure invoices have the right amounts and details.

- Real-Time Insight and Analytics

AI gives you instant access to financial data and insights. You can analyze current transactions and forecast future needs, which helps you make better decisions about cash flow and vendor relationships.

- Integrating with Existing ERP Systems

AI invoice processing works with your current ERP systems. This keeps your data in sync and your financial workflows running smoothly, with consistent information across all platforms.

- Machine Learning for Continuous Improvement

Machine learning helps your system learn from past data and get more accurate over time. This makes your automated billing processes more reliable as they continue to improve.

Benefits of AI-Based Invoice Processing

-

More efficiency: AI streamlines workflows and saves time, reducing the need to hire more staff. Automated systems eliminate repetitive tasks so your team can focus on more valuable work.

-

Fewer human errors: AI systems lower the risk of costly mistakes, including paying the same invoice twice. This keeps your financial records accurate.

-

Smart invoice management: AI automates data extraction and checking, improving both speed and accuracy for every invoice.

-

Better security and compliance: AI strengthens your financial controls with automated compliance checks, helping you follow regulations and avoid penalties.

-

Less fraud risk: AI spots suspicious patterns in invoices, helping to prevent financial losses from fraud.

-

Faster invoice processing: Quicker payment cycles let you take advantage of early payment discounts and avoid late fees.

-

Automatic invoice routing: AI quickly routes matched digital invoices for approval, speeding up the whole process.

-

Stronger supplier relationships: Timely payments and better communication build trust with your suppliers.

-

Real-time spending visibility: AI insights give you detailed spending analysis for better cash management.

-

Freed up accounting resources: Automated workflows let your accounting team focus on strategic finance work instead of manual tasks.

-

Digital transformation: AI helps implement industry best practices, boosting operational efficiency.

Tools for automated billing systems and AI invoice processing

-

Optical Character Recognition (OCR): OCR turns different invoice formats into text that computers can read. It pulls out data quickly and accurately, reducing errors that happen during manual processing.

-

Machine Learning Models: These models learn from past invoice patterns. They make data extraction more accurate, making your automated billing systems more reliable over time.

-

AI Invoicing Solutions: These specialized tools automate the entire invoicing cycle. They streamline processes like invoice matching and validation for faster approvals and payments.

-

Invoice Matching Software: This software automatically compares invoices with purchase orders and contracts. It keeps things accurate and compliant when handling lots of invoices.

-

Approval Workflow Automation: These tools automate invoice approvals by routing invoices through approval chains. This makes the process more efficient and faster.

-

Compliance Automation Checks: These checks make sure you follow internal policies and regulations. They help you avoid fines and legal issues.

-

Real-Time Analytics Tools: These tools give insights into your invoicing processes. They help you track performance and find ways to improve cash flow management.

-

ERP System Integration: Your automated billing systems should work smoothly with existing ERP systems. This keeps data management simple with real-time updates across financial operations.

Xero

Xero is cloud-based accounting software with AI features that make invoice processing easier. Here's what it offers:

-

Automatic Invoice Creation: Set up recurring invoices for regular clients, saving time and keeping money flowing in.

-

Quick Data Extraction: Uses OCR to pull key information from invoices, cutting down on manual entry and speeding up your process.

-

Automatic Checks: Validates invoice details against your records, catching mistakes before sending invoices to clients.

-

Streamlined Approvals: Routes invoices for approval automatically, ensuring timely payments and happy suppliers.

-

Instant Financial Insights: Tracks overdue invoices and cash flow trends, helping you manage finances proactively.

-

Works with Other Tools: Connects with various business systems to keep financial information consistent.

-

Custom Invoice Designs: Add your logo and brand colors to invoices while AI handles the behind-the-scenes work.

-

Expense Tracking: Keeps tabs on invoicing expenses, giving you better visibility into your financial health.

QuickBooks Online

QuickBooks Online makes invoicing easier with its AI tools. Here's how to use its features:

-

Set Up Automatic Invoicing: Configure QuickBooks to send invoices on schedule, cutting down on manual work and getting paid faster.

-

Use AI for Data Capture: Let QuickBooks scan invoices and pull out important information, reducing data entry and mistakes.

-

Set Up Payment Reminders: Create alerts for overdue invoices to stay on top of accounts receivable.

-

Match Invoices Automatically: QuickBooks pairs invoices with corresponding bills, improving accuracy by making sure what you receive matches expectations.

-

See Real-Time Reports: Access live dashboards showing overdue invoices and categorized expenses for better decision-making.

-

Connect Payment Systems: Link with payment processors to make it easier for clients to pay you quickly.

-

Fine-Tune Your Process: Regularly check your invoicing workflow and look for improvements by tracking performance.

Sage Intacct

Sage Intacct uses AI to make invoice processing faster and more accurate:

-

Speeds up invoice creation with automation, letting you generate and send invoices quickly and cut down on manual tasks.

-

Pulls data accurately from invoices using AI that learns different formats over time.

-

Manages workflows automatically with approval routing and invoice matching, reducing manual work and speeding up payments.

-

Catches errors by checking data during processing, keeping your financial records accurate.

-

Shows real-time insights into cash flow and outstanding invoices, helping you make smart financial decisions.

-

Works with your current systems, connecting all your financial data for better visibility and compliance.

-

Frees up your team from manual invoice tasks so they can focus on more strategic work.

[Visit Sage Intacct website](https://link.linezine.com/Sage Intacct)

Yooz

Yooz offers complete AI invoice processing to make your billing more efficient:

-

Faster Invoice Creation: Yooz speeds up invoice generation with automation. You can set up recurring billing to ensure invoices go out on time without manual work.

-

Smart Data Capture: Yooz uses AI to accurately pull and check invoice data. This cuts down on errors and lets your finance team focus on more important tasks.

-

Flexible Invoice Handling: The system works with different invoice formats and lets you customize templates to match your brand while still pulling data intelligently.

-

Automated Workflows: Yooz automates approval routing and payment tracking, making your accounts payable simpler. This leads to increased efficiency and faster payments.

-

Fewer Mistakes: The system runs automatic checks to catch errors and learns from past data to keep improving its accuracy.

-

Live Performance Tracking: Get instant insights into cash flow and outstanding invoices to make better financial decisions.

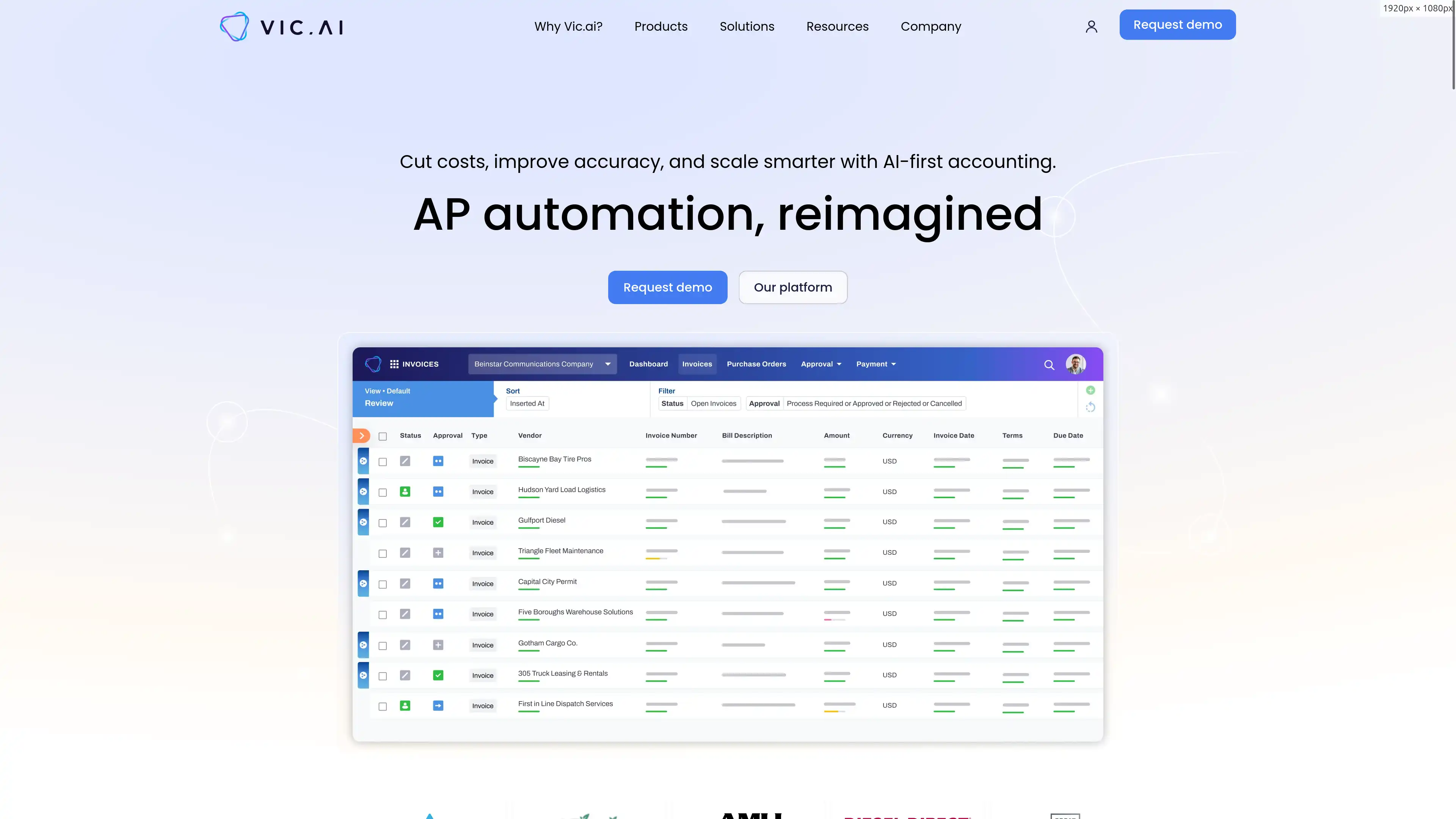

Vic.ai

Vic.ai stands out as a powerful AI tool for better invoice processing:

-

Automated invoice handling: Vic.ai streamlines the entire invoicing process. It automates invoice creation and management, speeding up your workflows and reducing manual work.

-

Smart data extraction: The system uses advanced AI to pull information from various invoice formats with high accuracy.

-

Workflow automation: Vic.ai automates approval processes and payment routing, leading to faster turnaround times and timely vendor payments.

-

Error reduction: The system's machine learning algorithms learn from past data, cutting down on invoicing mistakes and letting your team focus on strategic financial decisions.

-

Instant visibility: Vic.ai gives you real-time reporting on your invoicing and cash flow, helping you make better decisions and manage expenses more effectively.

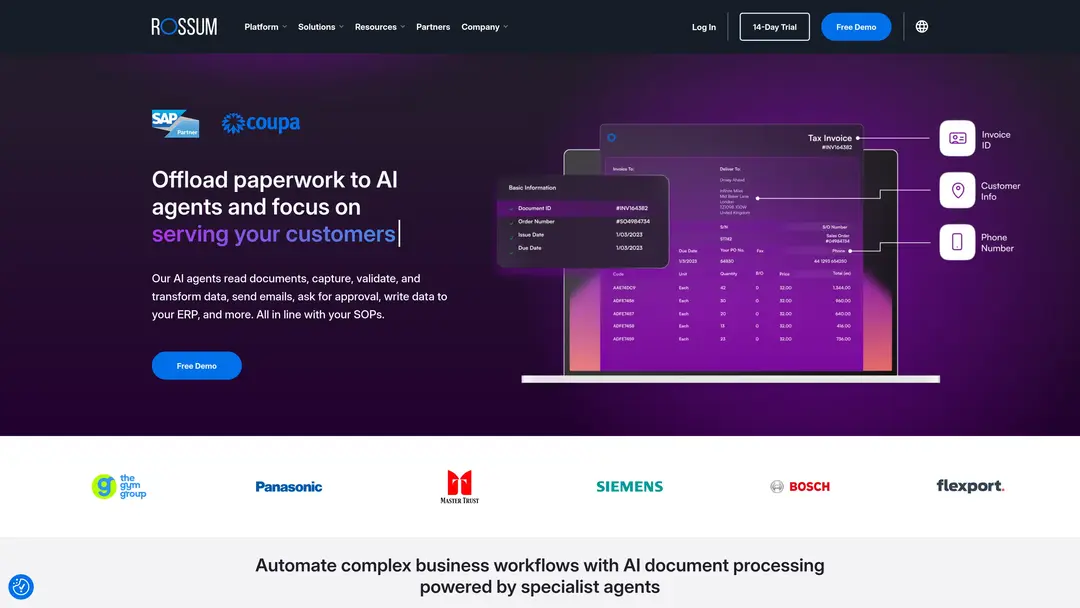

Rossum

Rossum offers AI invoice processing that makes handling invoices faster and more accurate:

-

Smart Data Extraction: Rossum uses machine learning to automatically pull key data from invoices, cutting down time spent on manual entry and reducing errors.

-

Works With Any Invoice: The system adapts to different invoice formats, making it easy to process invoices from various suppliers.

-

Instant Validation: Rossum runs automatic checks that flag problems right away, keeping your financial records accurate.

-

Automated Approvals: The system makes it easy to route invoices for approval, ensuring vendors get paid on time while you maintain control over spending.

-

Connects With Your Systems: Rossum works smoothly with your current accounting systems, syncing invoice data in real-time.

-

Gives You Insights: The platform shows you trends and stats that help you make better decisions and improve your billing processes.

-

Grows With You: Rossum scales as your business grows, working for companies of any size.

AI in Invoice Automation: Best Practices

- Check Your Current Process

Look at how you handle invoices now to find bottlenecks. Find the slow, error-prone steps that AI could improve. Do a full audit to set a starting point for measuring improvements.

- Pick the Right AI Tool

Choose an AI system that fits with your current setup. Look for tools that connect with your accounting software, process invoices in real-time, and help you stay compliant.

- Handle Multiple Invoice Types

Use AI that can work with different invoice formats. Good AI tools should recognize various layouts and pull data accurately from all of them.

- Train Your AI

Feed your AI system past invoice data. This helps it learn different invoice layouts, spot common errors, and get better at pulling out information over time.

- Automate Invoice Matching

Set up automatic invoice matching to streamline verification. Use AI to check invoice details against purchase orders and contracts for accuracy.

- Create Approval Workflows

Build smart approval workflows that sort and route invoices automatically. AI can make your accounts payable process more efficient, ensuring timely approvals and payments.

- Track AI Performance

Monitor how well your AI is working and tweak your automation rules as needed. Check if it's reducing errors and processing invoices faster to get the most from your AI system.

- Use Analytics for Insights

Add real-time analytics to gain useful insights. These can improve cash flow management and help you make smart decisions based on spending patterns and invoice processing performance.

Key Takeaways

-

Speed and Efficiency: AI automates data extraction and verification, cutting processing times and letting finance teams focus on strategic work.

-

Fewer Mistakes: Technologies like machine learning and OCR reduce human errors in data entry, creating more reliable financial records.

-

Live Insights: AI tools give instant access to financial data, helping with decision-making and cash flow management through analysis.

-

Easy Integration: AI invoice systems work with existing accounting software, improving financial workflow consistency and operational efficiency.

-

Fraud Prevention: Automation in invoice processing helps catch discrepancies, reducing fraud risks and ensuring compliance with regulations.

-

Adaptability: AI systems learn from past data, improving over time and adapting to different invoice formats, working for businesses of all sizes.

How to Implement AI in Your Invoice Processing

Adding AI to your invoice processing can transform your business operations. Start by looking at your current process to find areas for improvement. Choose an AI tool that works with your existing systems and handles various invoice formats.

After picking a tool, train it with your past invoice data to make it more accurate. Set up automated invoice matching and create approval workflows to streamline things. Keep an eye on how the AI performs to make sure you're getting the most from it. Following these steps unlocks the full benefits of AI, leading to better efficiency and letting your finance team focus on strategy rather than paperwork.